The Market Seen From the Street: Residential Building in Cacilhas, Selling Strategy

The case study I am presenting is grounded in a property owner's uncertainties concerning the appropriate selling strategy for his asset.

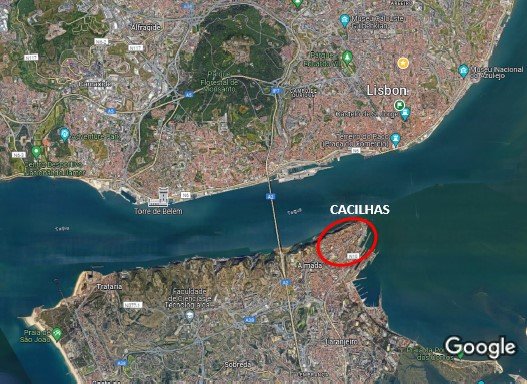

The asset under analysis has a residential use and it´s located in the Almada District, precisely in the emerging area of Cacilhas.

The Asset:

The Building was built in the 20th century, comprising stone masonry walls and a wooden structure between floors. The land plot encompasses approximately 417 m2, with building footprint area of 190 sqm. The free land area gives rise to a patio of 181 sqm, serving two residential units located on the ground floor. The building spans two floors.

Land Area: 417 sqm

Bulding Footprint: 190 sqm

Number of Floors Above Ground: 2

Number of Floors Below Ground: 0

Gross Building Area: 368 sqm

Gross Private Area: 339 sqm

Outdoor Spaces (Patios, Gardens, Balconies): 181 sqm

Common Areas (Staircase/Circulation Zones): 29 sqm

Number of Units: 4

Typologies: T2 + 1 / T3

Use: Residential

Cacilhas is increasingly positioning itself as a rising area in the real estate landscape of the suburbs of Lisbon. Its privileged connection to the capital through the ferry terminal, with an average crossing time of around 10 minutes, has been enhancing the attractiveness and development of its urban context.

The revitalization process of the infrastructure in the riverside area and its respective historical core, once neglected and undervalued, has been remarkable. The breathtaking views of Lisbon, proximity to the Cristo Rei monument, and the growing popularity of the beaches in Costa Caparica have significantly contributed to a solid increase in the number of tourists visiting the region.

Image 1 - Location

In light of the described scenario, the appreciation of real estate assets has been on the rise. However, even considering some level of "internationalization" in the market, one of the challenging factors is the "inelasticity of selling prices" for residential properties. Beyond a certain price threshold, despite potential enhancements in asset quality, demand lacks the "readiness" to match the associated cost increase.

Apparently, this market is highly sensitive to housing credit conditions. Regarding the rental market (long term, medium term, students, Airbnb), as is the case in practically all locations with easy access to Lisbon, demand significantly surpasses supply.

Residential property sale prices can reach 3400€/sqm, with an average value around 2800€/sqm, depending on the typology, specific location, and intrinsic features (outdoor spaces, views, finishes, parking, among others). The specified value range is indicative of a conservation status ranging from "Good" to "Very Good."

On the other hand, when attempting to estimate residential rents, “there is no sample”. This is a strong indicator of the potential of the residential rental market and its exceptionally high occupancy rates. Average unit rental values vary between 10 and 12€/sqm for long-term contracts.

Question: Considering the intention to maximize the current value of the asset, what are the different hypotheses of its owner?

· Hypothesis 1 - Residential Floor Expansion Licensing Process

From the perspective of real estate product conception, it would be the most interesting option. The opportunity to reconsider layouts and the respective arrangement of apartments, considering the incorporation of outdoor spaces on the upper floors, would bring significant improvements to the real estate product, certainly enhancing its attractiveness.

However, creating parking spaces would be unlikely as the demolition of existing structures and the creation of basements do not align with urban planning constraints. While there is an excellent backyard, considering its layout, obtaining "independent" parking spaces for all units would be unlikely. The circulation space has its specificities, and there is not much room for alteration. This reality may limit the creation of more units.

Taking into account the aforementioned, three floors are assumed as the maximum height, eliminating the need to incorporate an elevator. The constraints of the staircase layout also do not favor this aspect. However, we know that an elevator is valued for residential units located above the ground floor. Additionally, the absence of an elevator may deter potential clients with mobility constraints.

Considering the property's characteristics, Time and Construction Cost variables could significantly penalize the “land value”. The expansion operation would require significant structural reinforcement and a construction project of high complexity, despite the absence of relevant structural problems. Moreover, the licensing process has an indefinite timeframe.

Contemplated Architectural Solution:

Land Area: 417 sqm

Building footprint: 190 sqm

Number of Floors Above Ground: 3

Number of Floors Below Ground: 0

Gross Building Area: 554 sqm

Gross Private Area: 514 sqm

Outdoor Spaces (Patios, Gardens, Balconies): 234 sqm

Common Areas (Staircase/Circulation Zones): 41 sqm

Number of Units: 6

Typologies: T2 + 1 / T3

Use: Residential

One of the doubts that arises is the number of units to develop. We could choose to expand the existing units on the 1st floor, creating duplex apartments. This way, we would gain area by not having staircases or common areas on the new floor. However, I am of the opinion that selling prices above €300,000 are not very liquid in this location, considering the property's characteristics. Therefore, it would be preferable to add 2 more residential units to the existing 4, to avoid selling prices much higher than €300,000. There are considerable risks (related with the licensing) regarding the increase in the number of units given the parking constraints.

Table 1 - Tipology Mix and Potential Selling Prices, Hipothesis 1

As mentioned earlier, an architectural solution was adopted to enable unit sale prices not exceeding €300,000. The unitary sale prices reach €3,100/sqm.

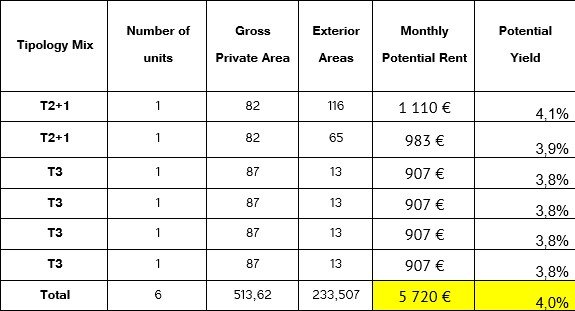

Table 2 - Tipology Mix and Potential Rents, Hipothesis 1

The potential rents of the future units would not be lower than what is shown in the table above. The potential rents and gross yields presented encompass a more conservative leasing solution, considering annual lease agreements.

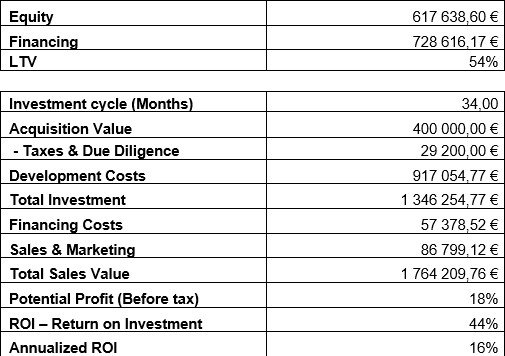

Below, the potential cost structure for the analyzed solution is presented:

Table 3 - Cost Structure and Investment Ratios, Hypothesis 1

Given the current economic situation, fixing costs is challenging when we have 34 months of the development cycle ahead. The time required for licensing is a "significant concern." We assumed 15 months to complete the licensing cycle and considered 19 months to complete rehabilitation work and obtain usage licenses.

It is important to note that the presented results are based on a static analysis method and assume the payment of IMT (Property Transfer Tax) upon acquisition of the asset. As a process of urban rehabilitation, where IMT is recoverable after the completion of the urban operation, the potential profit and return on investment could be optimized.

Hypothesis 2 - Renovation of the Existing Building, Simplified Licensing

Hypothesis 2 can be considered the “most obvious” for a potential buyer. There are some considerations to take into account, particularly regarding the condition of the building's structure. Assuming that there is no need to renovate/reinforce more than 20% of the building's structure, with no demolitions, expansions, and/or significant structural changes, the urban operation in question may exclude the need for licensing. Submitting a “Previous Communication process would be an option to consider.

The main objective is to reduce the Investment Cycle, limiting the bureaucracy of the process to the creation and registration of Horizontal Property, which will allow the sale of future units, during or after the completion of the renovation works (depending on the strategy).

Therefore, the area and respective characteristics of the building remain the same, but the development cycle decreases considerably, as does the overall investment volume (compared to option 1).

Contemplated Architectural Solution:

Land Area - 417 sqm

Building Footprint - 190 sqm

Number of Above Ground – 2

Number of Below-Ground– 0

Gross Consruction Area – 368 sqm

Gross Private Area - 339 sqm

Patios, Courtyards, Balconies – 181 sqm

Common Areas (Staircase/ Circulation Zones) – 29 m2

Number of Units: 4

Typologies: T2 + 1 | T3

Use: Residential

The number of residential units remains the same, as does the entire volume and morphology of the building.

Table 4 - Tipology Mix and Potential Selling Prices, Hipothesis 2

The analysis of the Mix of Typologies presented in the table above reveals the absence of outdoor spaces in the T3 apartments. Parking spaces are also not considered.

Just like in Hypothesis 1, the potential selling price of the units raises some doubts.

However, considering the development potential of the Cacilhas area and its surroundings, even though we are not considering "new construction" but rather very well-renovated apartments, we assume around €2725/m2 as the unit selling price (average).

Table 5 - Tipology Mix and Potential Rents, Hipothesis 2

If we take into account the investment from the perspective of the buyer of the renovated autonomous fractions who intends to put them on the rental market, we can assume that the Potential Average Yield could reach 4.4%. Once again, I remind you of the possibility of optimizing this ratio through medium-term leasing.

Next, we present the potential cost structure for the analyzed solution:

Table 6 - Cost Structure and Investment Ratios, Hypothesis 2

The results presented are based on a static analysis method and assume the payment of IMT upon the acquisition of the asset.

In the case of urban rehabilitation, since the IMT is recoverable after the completion of the urban operation, the potential profit or promotion margin and return on investment could be optimized.

Hypothesis 3 – Establishment and Registration of Horizontal Property, maintaining existing areas. Sale of individualized fractions without assuming renovation works.

Regarding the Mix of Typologies, the option is to maintain the existing, significantly improving living conditions and comfort, as defined in Hypothesis 2.

In terms of strategy, the objectives change. The owner assumes the cost associated with the creation and registration of a Horizontal Property. This solution "maximizes" the profitability of the process and maximizes the value of the land. However, the target customer will be different.

Table 7 - Mix of Typologies, Sale Values, and Global Investment Values, Hypothesis 3

As specified in the table above, the cost per unit significantly reduces for prospective buyers, even including the cost of separate renovations. The risk associated with managing the renovation/rehabilitation projects becomes part of their equation.

However, besides the investment cost per apartment decreasing significantly, there is also a tax benefit concerning IMT, as the incidence value reduces significantly. The risk-return balance seems to be reasonable. If we add the acquisition price and the cost of works, we have an average unit investment value of approximately €2374/m2, significantly below the values presented in Hypotheses 1 and 2.

Table 8 - Mix of Typologies and Potential Rental Values, Hypothesis 3

Also, when we compare the Yields associated with the investment, we obtain a considerable difference. Prospective buyers increase their profitability by about 1% if their intention is to invest in the rental market. The results consider a conservative rental solution, assuming annual contracts. It is possible to optimize profitability through medium-term stays.

Conclusions

The developed exercises and their respective solutions allow us to justify the different perspectives on the property's valuation.

The goal was to identify the best strategy to implement by the current owner, considering the attractiveness of the asset to the market as well as the risks associated with each hypothesis.

We all know that many investment decisions depend on various factors that can influence the options. Nevertheless, balance between the parties is essential. Otherwise, transactions cease to occur. Information is the fundamental ingredient for guiding investment and/or divestment decisions.

Table 9 - Comparative Matrix, Hypothesis 1,2&3

Hypothesis 1, given the licensing requirement, will be the option with the highest risk for the investor. For this reason, the value assigned to the land is significantly penalized.

The uncertainty creates more risk and devalues the land.

Analyzing from the perspective of the current owner or seller, the selling points are less robust since we assume there is a possibility of expansion that we cannot guarantee. There is always the licensing risk that can only be mitigated through the submission of a project for validation. This will be the option that brings the least commercial benefits to the seller and poses more development risks to a potential investor/promoter, taking into account the specificities already outlined.

Hypothesis 2 shows a significant reduction in the investment cycle, allowing greater flexibility and speed in the process. In addition, the total investment is significantly lower. The performance indicators used indicate a higher Annualized Return when compared to hypothesis 1, despite the Potential Profit and Potential Return having lower results. The table below demonstrates the differences between Hypothesis 1 and Hypothesis 2.

Table 10 - Hypothesis 1 vs Hypothesis 2

Finally, we have the most beneficial option for the seller, Hypothesis 3. The main change in this process is the target client and the need to invest in the registration of horizontal property. While in 1 and 2, the potential client was only one person/entity, in this case, the intention is to alienate the 4 apartments individually. All can be acquired by the same person or entity, but the truth is that we make the building more liquid and more versatile in terms of investment. We significantly increase the potential number of buyer clients. From the perspective of prospective buyers, if the motive is permanent own residence or purchase for profitability through the rental market, this will also be the option with the best performance.

Table 11 - Summary Hypothesis 1,2&3

Considering the assumptions presented, Hypothesis 3 is considered the best strategic option to defend the maximization of the current value of the building. There is a significant appreciation for a relatively low risk regarding the creation of Horizontal Property.

In the specific case, between Hypothesis 1 and Hypothesis 3, the difference in the appreciation of the land is around €150,000, approximately 33%. It would always be worthwhile to take on the risks associated with the registration of Horizontal Property.

Knowledge and information lead the value creation process in the real estate market. In growing markets, their value may not be as tangible, while in declining markets, their importance becomes entirely visible.