"The Market Seen from the Street": Preliminary Feasibility Analysis (Does This Exist?)

Analyzing the economic feasibility of a piece of land (or an existing building for renovation/rehabilitation) and defining its best use is an essential task when we refer to real estate development activities.

This analysis is as crucial for the asset buyer as it is for the seller. In case there is an intermediary, it can also be a significant support for conducting a win-win deal. Assumptions may vary somewhat among the parties involved in the transaction. However, if there are no well-founded assumptions, the negotiation can become unbalanced, leaning towards the party with more information “on hand”.

Often, viability is only analyzed after acquiring the asset (or a "promise of acquisition"), based on "poorly founded" or "unbinding" assumptions. It can go well or poorly. Theoretically, it goes better when we experience more dynamic and liquid market cycles and worse when we go through periods of greater uncertainty.

One thing is certain: THE VALUE OF A PIECE OF LAND PROPORTIONALLY DEPENDS ON ITS ABILITY TO CREATE/GENERATE VALUE.

Many professionals in our industry understand that the value of land is "the value that the market is willing to pay." Although I don't entirely disagree with this statement, the more "binding" the fundamentals supporting the operation are (for all parties involved), the fairer and more win-win the operation will be.

In my opinion, there is a myth regarding the process of creating value in real estate assets. It is commonly assumed that only the "Buyer" has the ability to create value. The "Seller," if not a professional in the market, depends entirely on the market's performance and their own financial condition. This is not true. The seller can also enhance the value of their asset before selling it. This is where the Real Estate Developer plays a crucial role in enhancing the value of land/buildings, as he interacts with all market stakeholders, is in constant contact with the market needs, and in fact, enhancing the value of real estate assets it´s the real value proposition of a Real Estate Developer. (article suggestion: https://andrecasaca.pt/articles/the-market-seen-from-the-street-what-i-have-learned-from-real-estate-development-activity )

Theories aside, let's proceed with a brief analysis of a real case for which I developed a "Preliminary Feasibility Analysis." It concerns a mixed-use property consisting of a rustic plot with a total area of approximately 7000 square meters and three urban articles totaling around 292.96 square meters.

It's worth mentioning that the urban articles are in poor condition, with some of them already in a state of ruin. Another relevant piece of information is the absence of any prior studies, submitted or validated projects.

Where to begin? Let's start with the location:

Palmela is the largest municipality on the Setúbal Peninsula, covering approximately 462 square kilometers and with a population of about 68,856 inhabitants (2021 Census, showing a positive variation of approximately 9.6% compared to 2011)

The lack of housing supply that meets the demands of the market, a situation similar to the rest of our country, has driven rental values and sales prices to extremely high levels.

The real estate products designed within the municipality often do not align with the market's demands. Many of them result from projects approved decades ago that have only recently come to fruition.

The geographic proximity to Lisbon and Setúbal, more established urban centers, makes the municipality an attractive destination for new residents. The positive population growth (9.6%) between 2011 and 2021 indicates a growing interest in the location.

In terms of distances from the property to "critical locations," I also consider the rationale to be quite favorable:

Palmela: 7 minutes (by car) - 3.6 km

Setúbal: 14 minutes (by car) - 8.1 km

Lisbon: 40 minutes (by car) - 42.2 km

Public Transportation (Fertagus Train): 11 minutes on foot, 3 minutes by car - 950 m

Supermarkets: 3/5 minutes (by car) - 1.3 km to 2.7 km

Public School: 2 minutes (by car) - 900 m

Private School (St. Peter School): 3 minutes (by car) - 1.5 km

Nearest Public Hospital: 14 minutes (by car) - 11 km

Nearest Private Hospital: 15 minutes (by car) - 8.8 km

The changing lifestyles of people in the post-COVID era and remote work opportunities (for some professional activities) allow these individuals to live "a bit farther" from their company headquarters (partly due to the prices in urban centers), which has led to a growing demand for housing in secondary or peripheral locations of major Portuguese cities.

Figure 1 - Macro Location, Geographic Position

So far, the data is promising.

Examining the real estate market in the area in detail, it quickly becomes evident that there is potential for creating distinctive products. It's no wonder that Teixeira Duarte (one of Portugal's leading construction companies) has invested in the area with its Sobral de Palmela project (https://www.sobraldepalmela.pt/), which has been highly successful in terms of sales.

All the small projects that have been developed nearby have had an excellent market absorption rate.

The "small villas" with a "good outdoor area" is the primary focus of demand.

After the initial exercise of understanding the market's needs, I began conceptualizing a Real Estate Project for the land, considering that the housing supply in the municipality is very weak in terms of product and differentiation.

I´ve started with the following assumptions:

Target Audience? Young families (between 30 and 45 years old).

Household Size? 2 to 4 people.

Average Household Income? €3,000 to €4,000 per month.

Concept? "Functional Homes," "Minimalism," "Nature," "Rural," "Community," "Quality," "Interior vs. Exterior Space Balance," Amenities (Sports & Office).

Types of Units? 2-bedroom and 3-bedroom (+ Office in the "Condominium," "Out of Home").

Type of Real Estate Development? Construction for sale, although I believe the area has enormous potential for Built to Rent with an "even more compact" product.

Next, the urban context of the land:

The plot is located in an Urban and Urbanizable Area, in category H1 - Medium-Density Expansion Area, therefore:

Gross Utilization Index: 0.4 | 7000 x 0.4 = 2800 sqm

Maximum Number of Units per hectare - 30

Maximum Facade Height - 6.5 m

Maximum Number of Floors - 2

Parking: Single-family housing GCA < 300 sqm = 2 spaces/unit

After this initial research work, I further refined the product concept in greater detail:

Type of Real Estate Development: Residential Condominium

Number of Units: 15

Land Area: 7000 sqm

Gross Construction Area: 1690 sqm

Gross Private Area: 1480 sqm

Number of Parking Spaces: 30 surface spaces

Common Areas: 250 sqm

Condominium Room: 50 sqm

Office Spaces/Storage: 180 sqm (12 sqm for each unit)

8. Other possibilities: Common Pool or "Mini Pool per unit"; Padel Court; Mini Playground; Gym Room;

People's needs have changed. The way of living has evolved. The way of inhabiting a home is different. Remote work is a new reality, although it doesn't suit all professional activities. Outdoor space is more valued than before. Peripheral areas have gained more attractiveness, with many families selling their properties in established urban centers, making significant profits.

All of this is true. But more than these points, I believe that people increasingly want to live "in community," building relationships with their neighbors as they did in the past. More than a trend, I feel it's a genuine need.

This is how I envision the Condominium. A dynamic space, lived by all its condominium owners, where everyone can have "their privacy," but at the same time, contact and "sharing" within the community are encouraged.

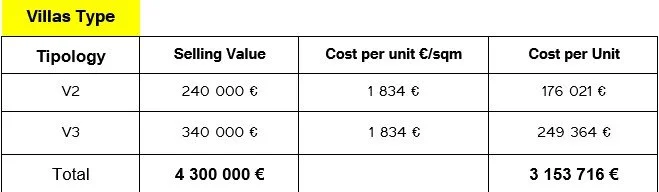

Figure 2 - Tipology Mix

The table above presents the Typology Mix. V2 and V3 houses situated on 160 sqm plots, within a condominium.

The V2 houses are 80 sqm, and the V3 houses are 120 sqm. In my concept, each unit should have an additional dependent area of about 12 sqm, outside the living space, which would allow working "out of home" but within the condominium, separating work from family and leisure. This seems very important from a mental health perspective.

The Condominium Room can serve as a "lounge" area where there could be a coffee machine, comfortable sofas, and some additional amenities to facilitate community gatherings for those using the offices for their professional activities, outside of their work area, or even to meet with clients.

In addition to the "workspace" within the condominium, the inclusion of a playground seems essential considering the defined target audience and the location's characteristics. The debate around amenities such as a paddle tennis court, a common pool, or individual pools, and a small gym requires further discussion to gain a better understanding of the flexibility of the selling price.

How much can it cost to develop a project of this nature, with minimalist finishes (without luxury) and using "off-site" or industrialized construction methods?

Figure 3 - Development Costs, excluding land value

The table above presents an estimate. Just that.

The assumed financing cost involves financing approximately 70% of the construction category.

I intentionally left the Land value at 0.

But why?

Because the Land value undergoes different appreciations throughout the development cycle.

If we don’t have any formal validation of the buildable volume (Request for Preliminary Information), the Land value is “arbitrary.”

If we have a validated Preliminary Information Request (PIP), we can substantiate the value more accurately based on the validated volume.

If we have an approved architectural project, the Land will have even more value.

If the construction permit is in progress, even more.

In short, as the development cycle progresses, “the land appreciates.” As we eliminate the temporal risk and uncertainty of development, we enhance the project’s value.

Figure 4 - Potential Sales Value vs Production Cost

The table presented above illustrates the Expected Overall Sales Volume in relation to the total cost (excluding the land value for the reasons previously explained).

Despite uncertainties regarding the project's development cycle (especially in terms of licensing timelines) and its urbanistic viability, the preliminary feasibility analysis allows us to give shape to the idea before validating the land acquisition or sale value and initiating costs related to projects and licensing.

The greatest risk will always be the validation of the idea in terms of licensing. Furthermore, considering the current interest rate situation, the market in question appears to be "price-sensitive." Nevertheless, there is potential to explore in the location under consideration; it's just a matter of creating the "right real estate products."

Next, in parallel, we begin a detailed analysis of the asset's documentation and the process of consulting the Municipal Council. This is where we begin to encounter "unwanted surprises."

Regarding the documentation, records with the tax authorities and in the land registry are "all in order." However, at the Municipal Council, only one of the urban articles has a usage license, and there is a need to prove that the buildings predate 1951.

How do we do that?

By obtaining Aerial Photographs from military flights taken before 1951 from the Directorate-General for Territorial Planning.

After obtaining these records and presenting them to the Municipal Council, it was concluded that there is no evidence to demonstrate that the buildings are from before 1951, and therefore, there are no conditions for the sale of the land until the situation is regularized.

How do you regularize it?

In my opinion, there are two possibilities.

License what is built "illegally," despite paying taxes for its existence and having proper records with the tax authorities.

Demolish what is illegal, despite paying taxes for its existence and having proper records with the tax authorities.

Considering that most of the buildings are uninhabitable ruins with little potential for restoration, does it make sense to incur costs and bureaucratic processes to "legalize" buildings that are properly registered with the tax authorities and in the land registry and pay taxes for their existence?

Well, it's debatable.

In practice, property owners are required to pay taxes under the threat of seizure but cannot sell the land "until regularization" of the situation. What if the owners don't have the money for regularization or demolition? Shouldn't special measures be considered for these cases? Solutions need to be found. It's not fair that property owners with similar situations cannot liquidate an asset for which they pay taxes, especially when dealing with old records.

Let's go back a bit. Does the "Project Idea" still make sense for the land in question?

Despite the urban context presented earlier, the municipality's interpretation regarding urban density is somewhat different.

Although it's always necessary to submit a Request for Preliminary Information(PIP) to confirm the viability of the urban operation, the technical indications suggest that no more than 5 units should be built, totaling no more than 1000 sqm of constructed area. Around 200 sqm per unit would result in selling prices that seem somewhat "out of reach."

The project may still be viable but does not align with the defined profile and concept. If we pursue the development of the initial idea, besides the likelihood of rejection being high, it would require delving into other licensing domains, and the required time is much longer.

In summary:

"Preliminary Feasibility Analysis" is very important in establishing the "value basis" for real estate assets (Land or Buildings) where there are doubts about their constructive potential and/or best use. It is equally important for Sellers and Buyers. Those with "less information" are at a disadvantage in a potential real estate transaction.

It's crucial to streamline the process of "knowing what I can do with my land/building." The analysis time for a Request for Preliminary Information(PIP) should not exceed 60 days.

Despite the sensitivity to sales values, the geographic location of the Municipality of Palmela and its intrinsic housing characteristics make me believe strongly in the development potential of the location. The "Built to Rent" product could also be very successful (the Palmela Village development, despite all its inefficiencies, has a very low vacancy rate and a waiting list for units that were developed for the rental market). It's inevitable that current urban assumptions need to be revised to find solutions that can meet people's needs.

I have learned that many municipalities are exercising preferential rights and acquiring residential units for the purpose of renting them out to increase supply. Most of these units will undergo improvements to enhance habitability. I have nothing against this. However, do we want to increase rental supply by buying residential units one by one? Does that make sense?

Given the circumstances explained, the land under analysis loses market potential due to existing constraints.

What seemed to make perfect sense at the beginning suddenly does not. At least for the specific land in question.

In any case, the presented concept is entirely replicable for other plots within the same area of influence or even in different locations.

See you soon,

André Casaca