The Market Seen from the Street: Why 41% of Fully Licensed Residential Projects Do Not Proceed?

Before addressing the title of this article, it is important to emphasize the relevance of housing accessibility and its impact on the social and political balance of the modern world. In Portugal, the challenge is no different.

Access to housing is a constitutional right, and as such, the state plays a crucial role in seeking solutions to mitigate current and future challenges.

These days, the imbalance between the average income of individuals, the prices and rents of "Residential Accommodations" in Portugal is evident. This reality has sparked much discussion and controversy.

The recent legislative elections in March 2024 demonstrated the importance of this issue. In all governance proposals presented by various political parties, Housing (or "Residential Accommodation") played a central role.

Unfortunately, the solutions are not obvious and simple. If we continue to approach the problem with superficial discussions dependent on the interests of the stakeholders, I fear it will only worsen.

Without properly analyzing the real causes, we will never implement an effective action plan that meets the needs of all housing market stakeholders, highlighting the people who need "residential accommodation" that meets their needs.

After this brief introduction, I will divide this article into three distinct parts.

First, I share an analysis of demographic and economic data that allows us to "x-ray" the current situation of the country at the level of housing needs.

Next, I will present a Case Study with obtained results and respective conclusions so that we can relate theory to practice.

The main objective of this structure is to present concrete data that allows for a thoughtful and informed reflection.

1) Demographic and Economic Facts

In 2022, the resident population in Portugal was about 10,444,242 people. Between 2011 and 2022, about 31% of the resident population would be 60 years or older, with about 12% being 75 years or older.

During the mentioned period, there was a decrease in the resident population by about 1,15%.

Table 1 – Resident Population in Portugal total and by age group 2011-2022

From 1991 to 2022, the average life expectancy increased from 74.1 years (Men = 70.6; Women = 77.6) to 81 years (Men = 78.1; Women = 83.5), i.e., about 9%.

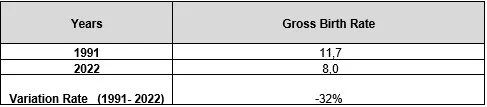

Additionally, during the same period, the birth rate decreased by about 32% (from 11.7 babies per 1000 residents to 8).

Table 2 – Average Life Expectancy 1991-2022

Table 3 – Gross Birth Rate

Between 2011 and 2022, there were 644,819 permanent immigrants, showing growth in immigration by 526%.

Table 4 – Permanent Immigration data by age group

Table 5 - Permanent Immigration data, 2011 vs 2022

Note: The data presented show a significant aging of the population that is expected to worsen in the coming years.

Despite the significant immigration movement recorded, which has been exponentially increasing in recent years, "population growth" is not expected.

In the case of immigration, there is also a very significant increase in people over 60 years old.

In 1991 there were 4,216,541 Classic Family Dwellings which increased to 6,002,874 Classic Family Dwellings by 2021.

There was an increase of 1,786,333 houses while the resident population increased by about 447,472 people.

In 1991, there were 3,147,286 Classic Families in Portugal, about 61% of which were made up of 3 or more individuals. In 2021, there were 4,149,096 Classic Families, about 58% of which were made up of 1 or 2 individuals.

Table 6 – Classic Families by number of individuals

Between 1995 and 2022, about 1,457,863 new houses were built, of which only 170,749 new houses were built between 2011 and 2022 (about 12% of the total). Of these, more than 67% had a Typology T3 or higher.

Table 7 – Number of new houses built by typology 1995-2022

Note: Between 1991 and 2021, there was a total transformation at the level of the constitution of classic families, and it is also evident a significant decrease in the number of new homes built post-Subprime.

However, it is curious to note that despite the change in "family typology," the typology of the houses remained similar, preferring "generous areas."

Considering that building more area per housing unit makes prices and rents higher, does it make sense to continue with the same logic when we have a problem of accessibility and cost?

As mentioned earlier, in 2021 there were about 6,002,874 classic family dwellings. Of these, 922,810 were registered with rental contracts, which is about 15.4% of the available housing stock.

Of the registered contracts, about 71% have rents below 400€ per month, and only 8% have rents above 650€ per month.

It is known to all that there is a "parallel rental market" without records. However, I do not have enough data to risk its sizing.

Even so, the need to grow the rental market for "residential accommodation" is more than evident.

Table 8 – Rental Accommodation by rent bracket

Analyzing the median bank appraisal values of houses in Portugal between 2011 and 2023, we see an average appreciation of about 42%. The annual appreciation amounts to about 4%.

However, it seems relevant to highlight the appreciation recorded between 2021 and 2023, which far exceeded the average annual recorded (almost triple). Studying the reasons for this event will be for another article.

The data suggest an interesting correlation between the increase in house prices and the period when "more money was printed" in history at low cost.

Table 9 – Median Bank Appraisal Values Summary, 2011 vs 2021 e 2021 vs 2023

Regarding the average available incomes of families between 2011 and 2021, there was an increase of about 24%. In 2021, the value amounted to 38,437.5€/year. If we consider that the household is composed of 2 people with professional activity, we can simply consider that the available income per person was around 1600€/month.

Thus, considering that about 58% of the total classic families are composed of 1 or 2 individuals, if we adopt the "effort rate rule" (a household should not spend more than 1/3 of its available income on its "residential accommodation"), we can suggest that on average, rents and/or monthly bank installments should not exceed 1068€/month (3203€ x 1/3) when households are composed of 2 active-age individuals.

In the case of households composed of 1 individual, rents should not exceed 534€ (1602€ x 1/3).

Table 10 – Average available income of families

The analysis of the average consumption expenses of families between 2011 and 2021 allows us to verify an increase of about 22%. Additionally, expenses on housing represented about 20% of the total, having increased about 13% in the indicated period. Simply put, on average, a family spent about 579€/month on their housing in the year 2021.

Table 11 – Average consumption expenses of families with goods and services (2011-2021)

Note: Demographics are, in my opinion, one of the main "Megatrends" that require careful analysis when intending to invest in the Real Estate Market in a thoughtful manner with a long-term value creation logic.

The data presented suggest the imbalance between market needs and the behavior of the housing supply.

Well, I know that statistics and data do not explain everything. However, they allow obtaining a more robust perspective of reality.

Before we analyze the Case Study, allow me to return to the title of this article.

Despite the experience I have been acquiring and the daily observation of market dynamics, in the first quarter of 2024, a study by Confidencial Imobiliário caught my attention.

Basically, it summarized that "in the last 5 years, about 41% of fully licensed Residential Projects did not proceed.”

I am fully aware of the "lack of adequacy" of many residential projects to market needs.

In any case, 41% is a significant magnitude and at the same time intriguing (for the "more inattentive").

Figure 1 – Source: Jornal Económico

Currently, every day we have the opportunity to hear or read some news related to the lack of housing supply in our country.

However, 41% of fully licensed projects do not become real.

With the intention of "feeling" the market's opinion, I conducted a poll on the social network LinkedIn.

As expected, the results suggest the "lack of attractiveness of the investment" (67%) as the main cause of this phenomenon.

Next, I share the results.

Note: I only obtained 56 responses (mainly from professionals active in the real estate sector), which does not allow any "statistical relevance."

Next, I highlight some of the reasons the market points out for the lack of viability of Residential Real Estate Projects:

"The blame lies with the state and the tax burden associated with the development of real estate projects."

"The blame lies with the Municipal Councils that take ages to license real estate projects."

"The blame lies with investors, developers, and builders who want to make a lot of money."

"The blame lies with banks that have raised interest rates."

"The blame lies with inflation and the increase in construction costs."

"The lack of labor in the construction sector greatly conditions the increase in supply."

"People's incomes are low and do not keep up with the rise in house prices."

"The immigration of recent years is the major cause of the lack of housing in Portugal."

I have been forming my opinion about the matter over the last few years.

I have no pretense of being right or wrong. I just aim to present my perspective based on experiences and facts.

I fully believe that one of the main reasons why many fully licensed residential projects do not proceed is their lack of suitability to the real market needs.

The urban regulation that governs us does not suit the country's needs, often forcing architectural solutions that do not allow the economic viability of projects.

The demographic and economic data previously presented clearly show an obvious need to rethink and adjust urban regulation so that different types of "Residential Accommodation" can be defined, with different regulatory obligations considering the various housing needs of the market.

People over 60 years old, fully independent, have different needs from those in the active age with dependent children, or students/young professionals who are displaced. The way these different users inhabit the space, their mobility, and their respective priorities in terms of location preferences, can be completely distinct.

The student population/young professionals can live in Student Residences or Co-Living Spaces. The independent senior population (who do not depend on full-time care) can live in residences that meet their needs, without the need to incorporate full-time medical care.

Aren't these types of "Residential Accommodations" Developments?

Do they need to be Equipment, "Special Housing Buildings" or Residential Structures for elderly people?

Sometimes I get the feeling that when it comes to housing in Portugal, the logic is always the same. The buy-and-sell market.

Just as there are already Residential Accommodation Projects for the student population and for the senior population strictly for the rental market with areas per typology different from a normal housing project, it is essential to create Residential Accommodation Projects for rental to displaced professionals, families, among others.

The architecture of the space, areas per typology, mandatory parking, amenities, etc., should be defined according to the needs of the future user of the space.

In this respect, I believe that the regulation greatly limits the viability of the projects (note that I have not yet referred to taxes, licensing timings, bureaucracy, costs, lack of labor, etc.).

If we have areas per typology and special urban regulation for student residences, senior residences, Co-Living buildings, etc., being these "residential accommodations," why not change the regulation regarding housing projects for families?

The logic is the same. Creating a residential accommodation project to meet a specific market need with a rental logic.

If we do not develop the rental market, I do not believe in the structured resolution of the problem of housing accessibility ("Residential Accommodation").

The viability of a residential project cannot depend solely on the profitability of the investment considering the sale of the units on the market.

It is necessary to create conditions to develop housing projects specifically for the rental market.

Furthermore, I believe it is necessary to evolve the model of bank appraisals for "used" properties. In consolidated urban areas (where the value of properties is usually higher), properties over 50/60 years old that are subject to "renovation" without any type of licensing or inspection (most of the time they are just painted and hide potential problems) are assessed considering the comparative sample without major additional constraints.

This reality often results in the appraisal value difference between a renovated used property and a new one with similar characteristics not being more than 20%.

If we take into account the risk associated with the development of a new construction/reconstruction/total rehabilitation project, we quickly realize that it is more profitable and much less risky to buy apartments whose building infrastructure life has ended but with good paintings and good home staging are valued according to the "comparative market sample."

The new European regulation associated with sustainability and ESG principles (environmental, social, and governance practices) may bring a new reality regarding the methods and models of appraisal. We shall see.

However, I am of the opinion that the depreciation of the value of used properties should reflect the associated constraints (life span of building systems) so that new construction/reconstruction/total rehabilitation projects can more often proceed, increasing the supply of "residential accommodation" according to people's needs.

In summary, it seems urgent to redefine the way Housing is thought about and made in Portugal.

2) The Case Study

To consolidate the assumptions and reflections I've gathered throughout this article, I'm sharing a real case with you.

As part of a request for a preliminary feasibility analysis of a residential real estate project in Maia (Porto Metropolitan Area), we developed a set of analyses that allowed us to obtain results and conclusions that merit attention.

Note: This case was developed in collaboration with Hugo Laranjeira (https://www.linkedin.com/in/hugo-laranjeira-999612164/), with whom I share all the merits of the work performed.

The starting point was a brief architectural study that defined some of the project's assumptions, according to the associated urban regulation:

Footprint Area: 560 sqm

Residential Area: 5040 sqm

Parking: 1680 sqm

Floors Above Ground: 9

Floors Below Ground: 3

Number of Units: 40

Mix of Typologies:

8 x T1: sqm

20 x T2: 105 – 120 sqm

12 x T3: 145 – 160 sqm

The approach to the case was divided into six phases:

1) Geographical Location.

As we all know, real estate investment heavily depends on three fundamental pillars: Location, Location, and Location. Understanding the local dynamics, points of interest, and specific characteristics of a location is crucial in the development process of a real estate project.

2)Demographic Analysis (AMPorto vs. Maia).

We analyzed and compared population data (total and different age groups, average family size, average income, number of owner-occupied homes, and number of families living in rented homes) to understand the characteristics and needs of the future users of the real estate development.

3)Contextualization of Supply and Demand.

3a) Properties Built in 2022.

Interestingly, we found that the number of units built in 2022 in Maia was the lowest among the municipalities analyzed in absolute numbers, also falling below the average in the number of units built per family unit.

Table 12 – Buit homes in 2022, by tipology

Of the units completed in 2022, 70% are of Typology T2 or T3, which seemed appropriate given the average size of families in the municipality.

3b) Residential New Properties, for Sale

The sample of new properties for sale shows a decrease in the selling price per square meter as the number of rooms per typology increases.

Table 13 – New Properties for sale, Summary

3c) Used Residential properties, for sale

The sample of used properties for sale, similar to new properties, shows a decrease in selling price per square meter as the number of rooms per typology increases.

Table 14- Used Properties for sale, Summary

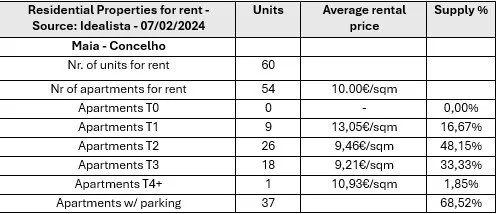

3d) Properties for rent

The analyzed data suggested the "nonexistence of a rental market." Assuming that one in every four families lives in rented houses, it is evident that the supply is too low to maintain this ratio (60 houses for rent vs 404 houses for sale).

It is also notable that the average unit rents decrease as the number of rooms increases in terms of typology.

Table 15 – Properties for rent, summary

3e) Mortgage Data - Expected Installment by Purchase Value.

We analyzed the metrics of mortgage lending to assess the financing capacity of potential buyers between €100,000 and €400,000.

6-month Euribor = 3.84%

Spread = 1%

Effort Rate: 33.33% of the Household's Monthly Income

LTV (Loan to Value): 70%, 80%, and 90%

Maturities: 20, 30, and 40 years

Table 16 - Indicative table of estimated bank installment and required net income

4) Analysis of the Architectural Solution Presented to Us

Considering the documents provided to us, which did not detail the architectural solution in full (brief conceptual study), we defined a mix of typologies and utilization of project areas based on the information obtained.

Note: Only the construction of 2 basement levels for parking was considered, although urban planning assumptions allowed for 3.

Table 17 - Distribution of Areas and Typologies by Floor, Initial Solution

Table 18 - Assumed Mix of Typologies, Considering Initial Architectural Assumptions

Table 19 – Ground Floor use definition

5) Recommendations and New Architectural Solution.

Considering the evidence and results from the analysis of demographic and economic data, as well as the contextualization of supply and demand, we made a set of recommendations and proposed a new solution for the project:

We suggested reducing the average size of the typologies, which would consequently increase the number of units.

A new Mix of Typologies was “created, increasing the number of independent units from 40 to 63.

An additional basement level was incorporated to allow for one parking space per unit (63 parking spaces).

Table 20 - Distribution of Areas and Typologies by Floor, Proposed Solution

Table 21 – Typologies Mix Proposed

Table 22 - Architectural Solution Ground Floor

6) Results/Conclusions Analysis

The study conducted and the various metrics analyzed suggest some contradictions regarding the residential product to be developed. The most relevant points are as follows:

1) Average Family Size in Maia suggest the development of "larger" typologies, in line with the market supply.

2) Average Income in the Municipality indicates that there are qualification limitations for potential buyers for mortgage loans on acquisition values above €250,000.

3) Average Selling Prices per Square Meter (€/m2) decreases as the area/number of rooms per typology of the residential units increases.

4) Average Rental Prices per Square Meter (€/m2) also decreases as the area/number of rooms per typology of the residential units increases.

Initial Project Solution vs. Proposed Solution

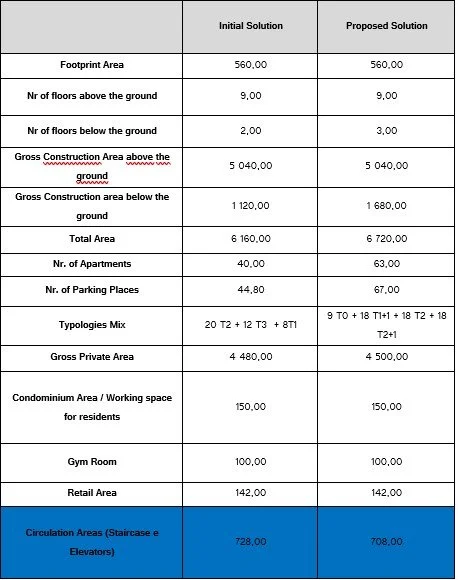

Table 23 allows us to verify that the Proposed Solution adds an additional basement to the initial project, considering the increase in the number of units (from 40 to 63) and the corresponding need to accommodate parking spaces for all units. Additionally, the most significant change occurs in the mix of typologies and their respective areas.

Table 23 - Initial Solution vs Proposed Solution, Architectural solutions summary

Regarding costs and potential revenues, the differences recorded are significant.

Table 24 highlights the potential benefits in terms of revenue and potential performance of the Proposed Solution, despite the increase in Total Investment Volume (+4.9%) and the respective average unit cost (+4.4%).

Note: VAT at 23% was considered.

Table 24 – Initial Solution vs Proposed solutions, Performance Summary

Finally, sales values, rents and housing loan installments were listed taking into account Maia's average income and the architectural solutions analyzed.

Table 25 summarizes the results obtained regarding the Initial Solution.

Taking into account the average income of the municipality of Maia, typologies with areas equal to or greater than 120 sqm present a considerable deviation (+33%) between average income and the net income required to approve financing.

Additionally, only Typology T1 (75 sqm) has a potential monthly income lower than the bank installment, taking into account the associated bank financing.

These results are based on the current level of interest rates, suggesting the unfeasibility of investment from the perspective of acquiring apartments to be placed on the housing rental market.

Table 25 – Initial Solution, Average Income Vs Buying Power

The following is Table 26, which summarizes the results obtained with the Proposed Solution.

In all the suggested typologies, the difference between the average income and the necessary net income to obtain financing does not exceed 33%.

Typologies up to 75 sqm are completely adjusted to the incomes of the people in the Maia municipality.

In this case, buying is 'cheaper' than renting. Note that we are only considering the monthly cost of rent/bank installment, without accounting for any taxes or ancillary costs.

Table 26 - Proposed Solution, Average Income Vs Buying Power

The case presented demonstrates that it is possible to increase the viability and consequent attractiveness of housing real estate projects without 'reinventing the wheel'.

The changes introduced between both solutions were merely architectural, without reducing taxes or construction costs.

We only altered the mix of typologies and their associated areas, leading to an increase in the number of parking spaces and consequent underground construction area.

More than increasing the financial attractiveness of the project, we managed to suggest a housing product according to the demand's needs.

However, I have to tell you, initially, 'everyone' told us that the solution didn't make sense because 'in Maia, only large typologies sell.'

In fact, the average size of families suggested just that. However, the data indicates that larger typologies have less value (€/sqm), and precisely those are on the market for a longer time, especially in new construction projects.

As I emphasized earlier in this article, when I develop preliminary feasibility analyses for real estate projects, I have no intention of being right or wrong.

The goal is to search and find the evidence that allows us to define the best product for a particular location, in order to increase investment performance and reduce associated risk.

The starting point is always the same: to respond to the needs of people or future users of the project.

See you soon,

André Casaca